Table of Contents

- Introduction: A Landmark Achievement

- About CFA Society Pakistan Awards

- Highlights of BankIslami’s Achievements

- What This Recognition Means

- Key Success Drivers

- The Road Ahead

- Conclusion

1. Introduction: A Landmark Achievement

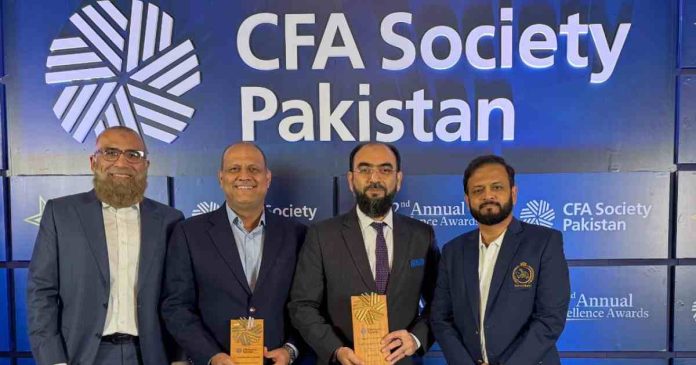

BankIslami Pakistan Limited has earned two distinguished titles at the 22nd Annual Excellence Awards hosted by the CFA Society Pakistan. The bank was named “Best Bank of the Year 2024” in the mid-sized bank category and secured the runner-up position for “Best Islamic Bank.”

These accolades celebrate BankIslami’s steady growth, strong governance, customer-centric focus, and purpose-driven operations. They also highlight the bank’s expanding influence within both the Islamic and conventional banking landscapes of Pakistan.

This double recognition demonstrates not only financial success but also integrity, innovation, and commitment to ethical banking practices — elements that continue to shape BankIslami’s brand identity.

2. About CFA Society Pakistan Awards

The CFA Society Pakistan Awards are considered among the most respected recognitions within the country’s financial industry. These awards celebrate excellence across multiple categories including banking, asset management, governance, and corporate reporting.

The CFA Society’s evaluation process is widely known for its transparency and rigor. Performance metrics, governance standards, innovation, financial resilience, and leadership practices are all assessed before final selections are made.

ALSO READ

Islamabad Food Authority Registration Deadline Guide for Restaurants

For the banking industry, receiving a title from this platform signifies that the institution has demonstrated excellence across multiple operational and ethical dimensions — a standard few achieve.

3. Highlights of BankIslami’s Achievements

BankIslami’s achievements this year speak volumes about its strategic direction and operational excellence.

- Best Bank of the Year 2024 (Mid-Sized Banks): The bank stood out for its steady growth, performance stability, and financial innovation in the mid-sized category.

- Best Islamic Bank (Runner-Up): This award acknowledged BankIslami’s strong contribution to Islamic banking, its expanding product line, and commitment to Shariah compliance.

The recognition also aligns with BankIslami’s broader purpose — “Saving Humanity from Riba” — a mission that continues to differentiate it in Pakistan’s competitive banking ecosystem.

With a network of over 550 branches in more than 200 cities, BankIslami has established itself as one of the fastest-growing Islamic banks in the country. Its customer-centric digital initiatives, expanding portfolio, and focus on ethical finance were key contributors to this achievement.

4. What This Recognition Means

Winning at the CFA Society Pakistan Awards is not just a matter of prestige — it represents validation from industry peers and financial experts. For BankIslami, this recognition holds several important implications:

- Strategic Validation: The awards affirm that the bank’s direction — combining innovation, technology, and faith-based principles — is both sound and sustainable.

- Stronger Market Positioning: Recognition enhances brand equity and customer trust, helping the bank stand apart in a market where competition is intensifying.

- Employee Motivation: Such accomplishments inspire pride within the organisation, boosting morale and attracting skilled professionals who align with its purpose.

- Investor and Stakeholder Confidence: Being publicly acknowledged for governance and performance enhances transparency and strengthens investor confidence.

Overall, this recognition positions BankIslami as a benchmark for modern Islamic banking in Pakistan.

5. Key Success Drivers

Several core factors have fueled BankIslami’s success story and enabled it to achieve recognition at a national level.

- Purpose-Driven Vision

The bank’s guiding principle — to save humanity from interest-based systems — continues to shape its identity, products, and communication. This vision has made BankIslami a trusted name in ethical finance. - Financial Growth and Innovation

Continuous expansion in profitability, assets, and market share highlights a strong financial foundation. The bank has also introduced innovative Islamic banking products that cater to both retail and corporate clients. - Digital Transformation

BankIslami’s digital platforms have improved customer accessibility and service quality. Mobile banking, online account services, and digital payment solutions have modernised the customer experience. - Governance and Compliance

Strong governance practices and adherence to both Shariah and regulatory frameworks have been instrumental in building long-term credibility and trust. - Expanding Network and Market Reach

A nationwide branch network combined with a growing customer base reflects the bank’s success in making Islamic banking more accessible to every segment of society. - Employee Commitment

Behind every achievement lies a motivated team. BankIslami’s employees continue to demonstrate professionalism, customer focus, and dedication to the organisation’s goals.

Together, these drivers have formed the foundation of the bank’s consistent performance and recognition.

6. The Road Ahead

While the awards mark an important milestone, they also set the stage for future goals. BankIslami aims to strengthen its position through innovation, digital advancement, and inclusive financial strategies.

- Further Digital Integration

The bank plans to expand its digital banking ecosystem, improving user experience and financial inclusion for individuals and small businesses alike. - Enhanced Islamic Banking Solutions

New Shariah-compliant investment options and financing products will further solidify the bank’s leadership in Islamic finance. - Sustainability and Green Finance

With global banking shifting towards ESG (Environmental, Social, and Governance) practices, BankIslami is expected to adopt sustainable banking initiatives that support ethical and responsible growth. - Continuous Improvement in Governance

The bank remains committed to strengthening its governance framework and maintaining transparency across operations. - Customer Empowerment and Financial Literacy

Through education and digital awareness, the bank continues to empower customers to make informed financial decisions aligned with Islamic principles.

These forward-looking strategies will ensure that BankIslami continues to evolve as a leader in the financial industry while staying true to its ethical mission.

7. Conclusion

The recognition of BankIslami Pakistan Limited as “Best Bank of the Year 2024” and “Best Islamic Bank (Runner-Up)” is a testament to its resilience, innovation, and unwavering commitment to ethical banking.

This achievement not only reflects financial strength but also reaffirms the institution’s dedication to principles that benefit society at large. As the banking landscape continues to evolve, BankIslami’s focus on purpose, governance, and customer empowerment ensures it remains at the forefront of sustainable Islamic finance.

These awards serve as a milestone — a sign that dedication to faith-based values and modern financial excellence can indeed coexist. BankIslami’s journey continues to inspire the future of ethical banking in Pakistan.