Pakistan Plans to Take Medical Exports to $30 Billion

Table of Contents

- Introduction

- Current Export Status

- Why Aim for $30 Billion

- Key Medical Export Sectors

- Government Policy & Reform Support

- Challenges to Overcome

- Opportunities for Growth

- Strategic Roadmap to $30 Billion

- Economic and Healthcare Impact

- Conclusion

1. Introduction

Pakistan is setting an ambitious target to expand its medical exports to $30 billion over the next five years. This includes pharmaceuticals, surgical instruments, medical devices, vaccines, and health-related technology. The plan represents a significant strategic shift in national policy—moving from an import-heavy health system to a global player in medical manufacturing and exports.

This target, though bold, is not impossible. Recent momentum in the health sector, along with reforms in regulations and manufacturing capabilities, has laid a foundation to scale exports and tap into the global medical market.

2. Current Export Status

As of the latest figures:

- Pharmaceutical exports are valued at under $500 million annually.

- Surgical goods and medical instruments contribute around $400 million.

- Overall combined health-related exports are estimated to be around $900 million.

These numbers are promising but fall short of the new target. Reaching $30 billion would mean increasing exports by more than thirtyfold—a challenge that will require structural transformation across the healthcare industry.

ALO READ Essential Medical Equipment Prices Skyrocket 5 Shocking Reasons Behind the Surge

3. Why Aim for $30 Billion

There are several reasons behind this ambitious goal:

- Global Demand Surge: Healthcare spending is increasing worldwide, especially after the pandemic. This opens up vast export opportunities.

- Economic Diversification: Increasing medical exports can reduce Pakistan’s reliance on textiles and raw materials, stabilizing the trade balance.

- Employment Generation: A booming export sector will create jobs across manufacturing, logistics, sales, and R&D.

- Foreign Exchange Reserves: High-value medical exports can improve the country’s reserves and reduce the fiscal deficit.

4. Key Medical Export Sectors

To achieve this target, Pakistan plans to focus on multiple export streams:

Pharmaceuticals

Generic medicines, over-the-counter drugs, and therapeutic products are expected to form the backbone of export growth.

Medical Devices

This includes diagnostic tools, surgical equipment, mobility aids, and devices like stents and catheters.

Surgical Instruments

Pakistan already has a strong base in this sector, particularly in precision instruments used in surgery and dentistry.

Vaccines and Biotech

The aim is to reduce dependency on imported vaccines and start producing them for export, especially for regional markets.

Health Technology

Digital health solutions, telemedicine platforms, and health-related software are seen as future export niches.

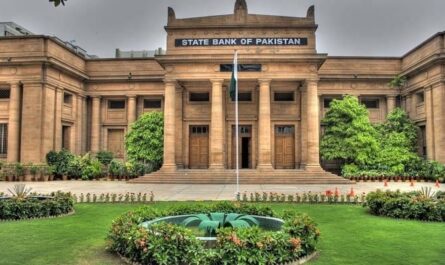

5. Government Policy & Reform Support

Several reforms and support policies are being introduced:

- Fast-Track Licensing: A new system allows faster approval for manufacturing and exporting medical devices.

- Regulatory Improvements: Efforts are being made to align with international standards such as WHO, FDA, and CE certifications.

- Tax Incentives: Potential tax breaks and duty exemptions on the import of raw materials and machinery for medical exports.

- Export Facilitation: Institutions are being tasked to help exporters with market research, compliance, and logistics support.

- Investment Promotion: The government is encouraging both local and foreign investment in healthcare manufacturing zones.

6. Challenges to Overcome

Despite the growth potential, the path to $30 billion is filled with challenges:

- Raw Material Dependence: Most pharmaceutical ingredients and medical components are imported, adding cost and vulnerability.

- Quality Standards: Strict international regulations require high-level certifications that many local firms are still working toward.

- Infrastructure Gaps: Transport, storage, and lab-testing facilities need upgrades to support high-volume exports.

- Skilled Workforce: There’s a shortage of trained professionals in biotechnology, device engineering, and regulatory affairs.

- Global Competition: Countries like India, China, and Turkey have a strong foothold in international medical markets.

7. Opportunities for Growth

Pakistan can leverage several advantages:

- Cost-Effective Manufacturing: Lower labor and operational costs give Pakistan a pricing edge.

- Strategic Location: Proximity to Central Asia, the Middle East, and Africa makes it a natural export hub.

- Established Industry Clusters: Sialkot and Karachi already produce quality surgical and pharmaceutical products.

- Untapped Markets: Many African, Central Asian, and Middle Eastern countries are looking for affordable medical suppliers.

8. Strategic Roadmap to $30 Billion

A phased roadmap is essential to achieve the export target:

Phase 1 (1–2 years)

- Streamline regulatory approvals

- Build certification and compliance capacity

- Strengthen core product segments like generics and surgical tools

Phase 2 (3–4 years)

- Expand into advanced devices and digital health

- Form joint ventures with international firms

- Upgrade infrastructure and logistics

Phase 3 (5+ years)

- Invest in R&D and biotech

- Launch branded Pakistani healthcare products globally

- Position Pakistan as a preferred healthcare export destination

9. Economic and Healthcare Impact

If the $30 billion target is achieved, the ripple effects will be profound:

- Boost to GDP: Export-led growth in the healthcare sector will contribute significantly to the national economy.

- Job Creation: Tens of thousands of new jobs will emerge in manufacturing, sales, logistics, and healthcare IT.

- Healthcare Quality: Increased domestic production may also lead to better availability and affordability of medical products locally.

- Stronger Currency: A rise in exports will improve the trade balance and strengthen the currency.

10. Conclusion

Pakistan’s vision of reaching $30 billion in medical exports is ambitious, but it comes at a time when global healthcare needs are expanding. With the right mix of government policy, industry innovation, and international collaboration, this goal is within reach.

To succeed, Pakistan must focus not just on quantity, but on quality, compliance, and brand building. By capitalizing on its strategic location, low-cost advantages, and growing industrial capacity, the country can emerge as a major player in the global medical export market.