Table of Contents

- Introduction

- Background: Pakistan’s Fiscal Challenges

- Proposed Budget Cuts and Key Sectors Affected

- Reasons Behind the Revenue Shortfall

- Potential Impact on Development Projects

- Reactions from Economists and Analysts

- Measures to Offset the Shortfall

- Conclusion

1. Introduction

The Government of Pakistan is reportedly considering a Rs. 300 billion cut in the national development budget in response to mounting revenue shortfalls. This move is part of a broader effort to manage fiscal deficits and ensure financial stability amid economic pressures.

The potential reduction in development spending could impact infrastructure projects, social programs, and investment plans across multiple sectors, raising concerns about slowing economic growth.

2. Background: Pakistan’s Fiscal Challenges

Pakistan has been facing persistent budgetary and fiscal challenges. Revenue collection has fallen short of targets due to declining tax receipts and underperformance in key sectors.

At the same time, expenditures have continued to rise, driven by debt servicing, subsidies, and recurring government costs. This widening fiscal gap has prompted the government to consider prudent budgetary adjustments.

3. Proposed Budget Cuts and Key Sectors Affected

The government’s proposed Rs. 300 billion cut will primarily target the development budget, which funds public sector development programs (PSDP) across various provinces and ministries.

ALSO READ

HUBCO Thar Coal Plants Reach Completion Under CPEC and Prepare to Reward Shareholders

Key sectors likely to be affected include:

- Infrastructure projects: Roads, bridges, and urban development initiatives.

- Energy sector: New power projects and ongoing coal, hydro, or renewable energy projects.

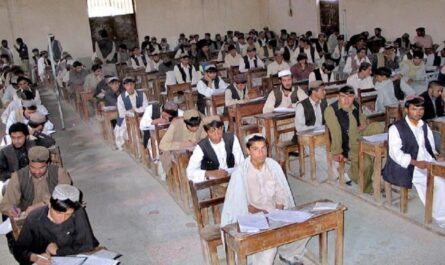

- Social programs: Education, health, and poverty alleviation schemes.

Officials have emphasized that while some projects may face delays, the government aims to prioritize critical initiatives to minimize disruption.

4. Reasons Behind the Revenue Shortfall

Several factors have contributed to the revenue shortfall:

- Decline in tax collection: Underperformance of income and sales tax receipts.

- Slow economic growth: Lower industrial output and reduced business activity.

- Inflationary pressures: Rising prices have affected consumption patterns, reducing indirect tax collection.

- Global economic uncertainties: Currency fluctuations and trade imbalances have affected revenue inflows.

These challenges have left the government with limited fiscal space, forcing consideration of budget cuts.

5. Potential Impact on Development Projects

If implemented, the Rs. 300 billion reduction could:

- Delay completion of ongoing infrastructure projects.

- Reduce funding for new development initiatives.

- Affect provincial allocations, especially in regions dependent on federal development funding.

However, some experts believe that careful reprioritization could mitigate the negative effects, ensuring that essential projects continue while non-critical initiatives are deferred.

According to the Ministry of Finance, Government of Pakistan, updates on the national development budget and fiscal policies can be found here

6. Reactions from Economists and Analysts

Economists have expressed mixed views on the proposed cuts. Some argue that reducing development spending could slow economic growth, as infrastructure and social programs are key drivers of employment and productivity.

Others contend that in the short term, the cuts are necessary to stabilize public finances, especially in light of rising debt servicing obligations and fiscal deficits.

Analysts also stress the importance of structural reforms, including improved tax administration and public sector efficiency, to prevent future revenue shortfalls.

7. Measures to Offset the Shortfall

To address the revenue gap, the government is exploring several measures:

- Enhanced tax collection efforts: Broadening the tax base and improving compliance.

- Public-private partnerships (PPPs): Leveraging private investment for infrastructure projects.

- Expenditure rationalization: Cutting non-essential spending without affecting critical services.

- External funding and grants: Securing support from development partners for priority projects.

These measures aim to ensure that development goals are not entirely compromised despite budgetary constraints

8. Conclusion

The government’s consideration of a Rs. 300 billion cut in the development budget highlights the fiscal challenges Pakistan is currently facing. While the move is aimed at controlling the deficit, it may affect infrastructure, social programs, and economic growth.

Effective prioritization, structural reforms, and innovative financing strategies will be key to mitigating the impact of reduced development spending. Policymakers will need to balance fiscal responsibility with the need to sustain development momentum and economic stability.

The coming weeks are likely to reveal the final decisions on budget adjustments, shaping Pakistan’s development trajectory in the short and medium term.